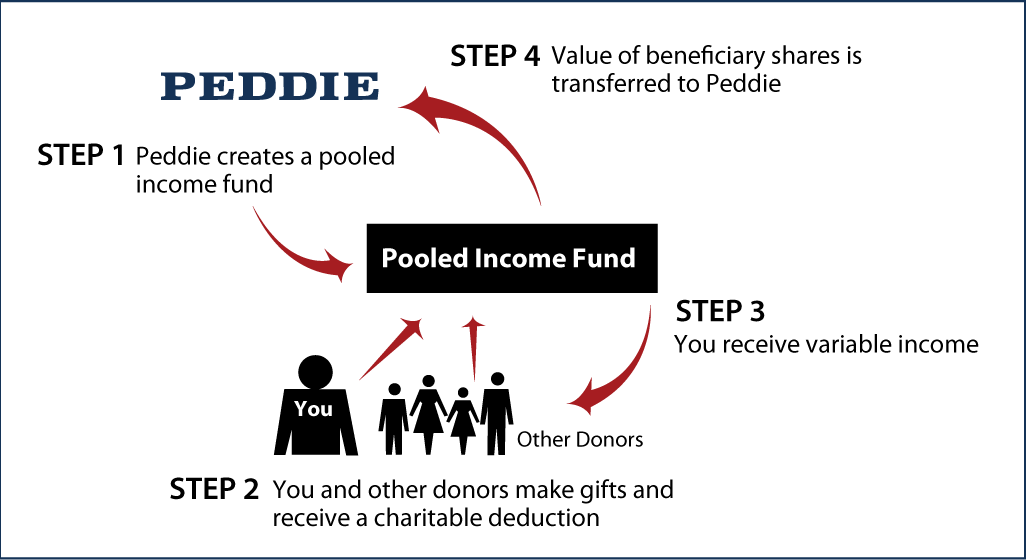

Pooled Income Fund

How It Works

- You sign pooled income fund (PIF) agreement and designate the income beneficiaries

- You transfer cash or appreciated securities to trustee and receive an income-tax deduction (your gift will be co-mingled with similar gifts of other donors and invested and managed by a trustee)

- Trustee makes quarterly payments to income beneficiaries for their lifetimes

- Remainder goes to Peddie for purposes you specify

Benefits

- You or one or more beneficiaries will receive income annually that varies with the value of the trust each year

- You will receive a federal income-tax deduction for the present value of charity's remainder interest in your portion of the PIF

- You will not be taxed on capital gain when appreciated assets are donated and sold

- Pooled fund remainder will provide generous support for Peddie

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Amy Cabot

Director of Gift Planning

and Leadership Giving Officer

(609) 944-7614

acabot@peddie.org

The Peddie School

Office of Alumni & Development

201 S. Main Street

Hightstown, NJ 08520

Federal Tax ID Number: 21-0634492

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer